Cybersecurity has become a top priority as insurance companies continue to digitize their operations. Cyber attacks can result in significant financial losses, reputational damage, and legal liabilities. Therefore, insurance companies must implement best practices to protect their sensitive data and ensure their customers’ information security.

Understanding Cybersecurity is the first step toward implementing effective measures. Insurance companies must identify their vulnerabilities and assess the risks associated with their operations. A Cybersecurity Framework for Insurance Companies can guide managing these risks and establishing a comprehensive cybersecurity program. This framework can help insurance companies to identify, protect, detect, respond, and recover from cyber-attacks.

Implementing Cybersecurity Measures is the next step. Insurance companies must ensure their employees are trained on best practices, such as password management, data encryption, and secure communication. They must also implement technical measures like firewalls, intrusion detection systems, and security software. Legal and Compliance Aspects must also be considered, as insurance companies must comply with regulations and standards, such as GDPR, HIPAA, and PCI DSS.

Key Takeaways

- Understanding Cybersecurity is crucial for insurance companies to identify their vulnerabilities and assess the risks associated with their operations.

- A Cybersecurity Framework for Insurance Companies can guide managing these risks and establishing a comprehensive cybersecurity program.

- Implementing Cybersecurity Measures, including employee training, technical measures, and legal and compliance aspects, can help insurance companies to protect their sensitive data and ensure the security of their customers’ information.

Understanding Cybersecurity

As an insurance company, we deal with sensitive customer information daily. This includes personally identifiable information (PII) such as social security numbers, credit card information, and medical records. Protecting this information is critical to maintaining the trust of our customers and avoiding costly data breaches. That’s why understanding Cybersecurity is essential for our business.

Importance of Cybersecurity in Insurance

The insurance industry is a prime target for cyber attacks due to the vast amounts of valuable data stored and transmitted. A successful cyber attack can result in financial losses, legal liabilities, and damage to our reputation. Therefore, we must take proactive measures to prevent and mitigate cyber threats.

One way to do this is by implementing a robust cybersecurity framework. This includes measures such as:

- Regularly updating software and systems to patch known vulnerabilities

- Conducting regular security assessments and penetration testing

- Implementing access controls and password policies

- Providing cybersecurity training to employees

- Having an incident response plan in place

By implementing these measures, we can reduce the risk of cyber-attacks and better protect our customers’ data.

Types of Cyber Threats

There are many different types of cyber threats that insurance companies should be aware of. Some of the most common include:

- Phishing attacks: These are fraudulent emails or messages that trick users into revealing sensitive information or downloading malware.

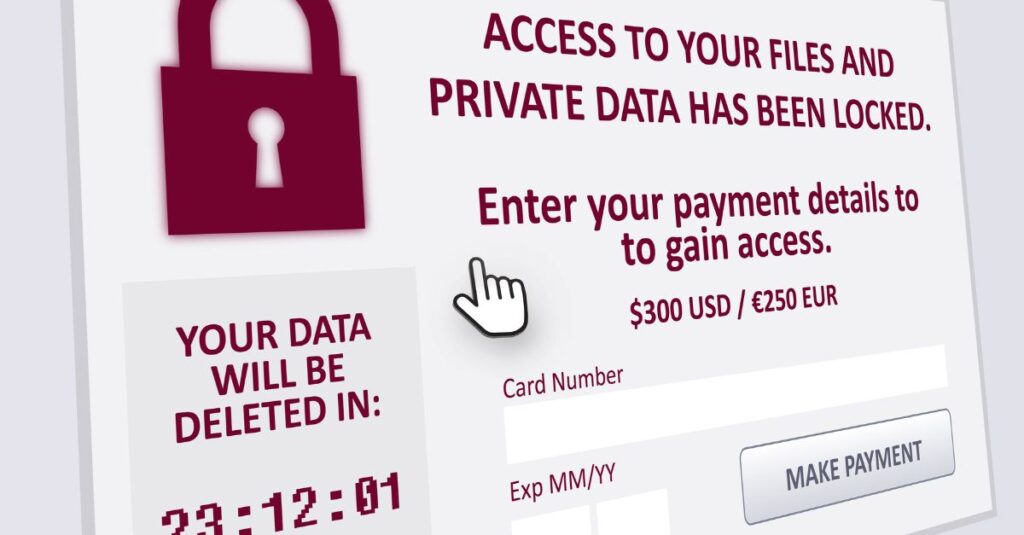

- Ransomware: This is a type of malware that encrypts files and demands payment in exchange for the decryption key.

- Insider threats: These are threats posed by employees or contractors who have access to sensitive data and may intentionally or unintentionally misuse it.

- Distributed Denial of Service (DDoS) attacks: These are attacks that overwhelm a website or network with traffic, causing it to become unavailable.

By understanding the different types of cyber threats, we can better prepare for and prevent them. It is crucial to have a multi-layered approach to Cybersecurity that includes technical and non-technical controls.

Cybersecurity Framework for Insurance Companies

At Ascend, we take Cybersecurity very seriously. We understand the importance of protecting sensitive information and have implemented a comprehensive cybersecurity framework to ensure the safety of our customers’ data. Our framework includes the following sub-sections:

Risk Assessment

The first step in our cybersecurity framework is conducting a thorough risk assessment. We identify potential threats and vulnerabilities to our systems and data and evaluate each threat’s likelihood and potential impact. This helps us prioritize our security efforts and allocate resources effectively.

Protection Strategies

Once we have identified potential risks, we implement protection strategies to prevent or mitigate those risks. This includes implementing firewalls, antivirus software, and intrusion detection systems, as well as encrypting sensitive data and limiting access to authorized personnel only. We also ensure that all employees are trained in Cybersecurity best practices and regularly update our security protocols to stay ahead of emerging threats.

Detection Methods

In addition to prevention strategies, we have detection methods to identify and respond to potential security breaches quickly. This includes monitoring our systems and networks for unusual activity, conducting regular security audits, and implementing incident response plans to contain and remediate any violations that occur quickly.

Response and Recovery

Finally, we have a comprehensive response and recovery plan in place in the event of a security breach. This includes notifying affected parties, investigating the cause of the breach, and taking steps to prevent future incidents. We also have procedures in place to recover lost or damaged data and systems, ensuring minimal disruption to our operations and customers.

Overall, our cybersecurity framework is designed to provide comprehensive protection for our systems and data while ensuring we can quickly detect and respond to any potential threats. By staying vigilant and proactive in our security efforts, we can give our customers the peace of mind they deserve.

Implementing Cybersecurity Measures

As an insurance company, we understand the importance of protecting our clients’ sensitive information from cyber threats. Implementing cybersecurity measures is crucial to safeguard against data breaches and cyber-attacks. This section will discuss some best practices for implementing cybersecurity measures.

Employee Training

One of the most essential cybersecurity measures is employee training. Employees should be educated on the latest cybersecurity threats and trained to identify and report suspicious activity. Regular training sessions should be conducted to ensure that employees are up-to-date on the latest threats and best practices for preventing cyber attacks.

Regular Software Updates

Another important cybersecurity measure is to ensure that all software is up-to-date. Outdated software can leave vulnerabilities that cybercriminals can exploit. Regular software updates are crucial to patching these vulnerabilities and securing our systems.

Data Encryption

Data encryption is another crucial cybersecurity measure. Encryption ensures that sensitive information is not accessible to unauthorized individuals. All sensitive data should be encrypted both in storage and in transit. This includes data stored on servers, laptops, and other devices.

Multi-Factor Authentication

Multi-factor authentication is another vital cybersecurity measure that can prevent unauthorized access to our systems. Multi-factor authentication requires users to provide multiple forms of identification before accessing our systems. This can include a password, a fingerprint scan, or a security token.

By implementing these cybersecurity measures, we can protect our client’s sensitive information from cyber threats. Regular training, software updates, data encryption, and multi-factor authentication are all crucial components of a comprehensive cybersecurity strategy.

Legal and Compliance Aspects

When it comes to Cybersecurity for insurance companies, legal and compliance aspects are crucial. We must be aware of the various data privacy laws and insurance industry regulations governing our operations. This section will discuss two important sub-topics: Data Privacy Laws and Insurance Industry Regulations.

Data Privacy Laws

Data privacy laws are regulations that govern the collection, use, storage, and sharing of personal information. Insurance companies collect many personal data from their customers, such as names, addresses, social security numbers, and medical information. Therefore, it is critical to comply with data privacy laws, such as the California Consumer Privacy Act (CCPA), the General Data Protection Regulation (GDPR), and the Health Insurance Portability and Accountability Act (HIPAA).

To comply with these laws, we must implement appropriate security measures to protect personal information from unauthorized access, use, or disclosure. We also need to provide our customers with clear and concise privacy notices that explain how we collect, use, and share their personal information. In addition, we need to give our customers the right to access, correct, and delete their personal information upon request.

Insurance Industry Regulations

Insurance industry regulations are rules that govern the operations of insurance companies. These regulations are designed to protect consumers and ensure that insurance companies operate fairly and transparently. Examples of insurance industry regulations include the National Association of Insurance Commissioners (NAIC) Model Laws and Regulations, the New York State Department of Financial Services (NYDFS) Cybersecurity Regulation, and the European Insurance and Occupational Pensions Authority (EIOPA) Guidelines on Cybersecurity.

To comply with these regulations, we must implement appropriate security controls to protect our systems and data from cyber threats. We must also conduct regular risk assessments to identify potential vulnerabilities and develop mitigation strategies. In addition, we need to provide our customers with clear and concise information about our products and services, including any limitations or exclusions.

In summary, legal and compliance aspects are critical to our cybersecurity efforts. We can protect our customers’ personal information and maintain their trust by complying with data privacy laws and insurance industry regulations.

Case Studies of Cyber Attacks in Insurance Companies

Insurance companies handle sensitive personal and financial information, so they are prime targets for cyber attacks. Here are a few case studies of cyber attacks that have impacted insurance companies in recent years:

Anthem Inc.

In 2015, Anthem Inc., one of the largest health insurers in the United States, suffered a massive data breach. Cybercriminals accessed the personal information of approximately 80 million current and former customers and employees. The stolen data included names, birth dates, social security numbers, phone numbers, and email addresses. The breach was caused by a spear-phishing attack that targeted an Anthem subsidiary. The attackers used stolen credentials to access Anthem’s systems and steal data.

Zurich Insurance Group

In 2014, Zurich Insurance Group, a Swiss insurance company, suffered a data breach that exposed the personal information of approximately 640,000 customers. The breach was caused by a third-party supplier who accidentally sent unencrypted data to a server in South Africa. The data included names, addresses, policy numbers, and banking information. Zurich Insurance Group notified affected customers and offered them free credit monitoring services.

Equifax

In 2017, Equifax, a credit reporting agency, suffered a data breach that exposed the personal information of approximately 143 million Americans. The breach was caused by a vulnerability in Equifax’s web application software. The attackers accessed names, birth dates, social security numbers, addresses, and driver’s license numbers. The breach also exposed the credit card numbers of approximately 209,000 customers. Equifax faced a public backlash for its slow response to the violation and handling of the aftermath.

These case studies demonstrate the importance of implementing strong cybersecurity measures and regularly reviewing third-party vendor security practices. Insurance companies must prioritize protecting customer data and ensure that all employees and vendors are aware of the risks of cyber attacks.

Conclusion

In conclusion, Cybersecurity is a crucial aspect of the insurance industry that cannot be overlooked. Insurance companies must prioritize Cybersecurity to protect their client’s sensitive data and maintain their reputation.

To achieve this, insurance companies should implement various best practices, such as conducting regular risk assessments, providing employee training, and implementing multi-factor authentication. It is also essential to stay up-to-date with the latest cybersecurity threats and technologies and to work with trusted cybersecurity vendors.

We must remember that Cybersecurity is an ongoing battle that requires constant attention and effort. Insurance companies must remain vigilant and proactive in their cybersecurity efforts to stay ahead of potential threats.

}By following these best practices, insurance companies can better protect themselves and their clients from cyber attacks, maintain trust and confidence in their services, and ultimately achieve long-term success.

Frequently Asked Questions

How can insurance companies protect against cyber attacks?

As an insurance company, we can protect against cyber attacks by implementing robust security measures such as firewalls, intrusion detection and prevention systems, and encryption technologies. We can also conduct regular security audits and vulnerability assessments to identify and mitigate potential security risks. Additionally, we can educate our employees on Cybersecurity best practices and implement strict access controls to limit access to sensitive data.

What are the most common cyber threats faced by insurance companies?

Insurance companies face various cyber threats, including phishing attacks, malware infections, ransomware attacks, and insider threats. Phishing attacks are among the most common threats, where attackers use fraudulent emails or messages to trick employees into sharing sensitive information or clicking on malicious links. Ransomware attacks are also a significant threat, where attackers encrypt an organization’s data and demand payment for the decryption key.

What are the essential cybersecurity requirements for insurance companies?

As an insurance company, we must comply with various cybersecurity regulations and standards, such as the National Institute of Standards and Technology (NIST) Cybersecurity Framework, the General Data Protection Regulation (GDPR), and the Payment Card Industry Data Security Standard (PCI DSS). We must also implement robust security controls such as access, encryption, and network segmentation to protect sensitive data.

How can insurance companies ensure data protection in the sector?

To ensure data protection, we can implement a data classification policy to identify and classify sensitive data. We can also implement data loss prevention (DLP) technologies to monitor and prevent unauthorized access or exfiltration of sensitive data. Additionally, we can regularly back up data and test our backup and recovery procedures to ensure data availability during a cyber attack.

Why is authentication and authorization critical for insurance companies?

Authentication and authorization are critical for insurance companies to ensure that only authorized users can access sensitive data. We can implement multi-factor authentication (MFA) to strengthen authentication and authorization controls. We can also implement role-based access controls (RBAC) to ensure users only have access to the data and systems necessary for their job function.

What are the top 5 cybersecurity best practices for insurance companies?

The top 5 cybersecurity best practices for insurance companies are:

- Conduct regular security assessments and vulnerability testing to identify and mitigate potential security risks.

- Implement robust access controls and authentication mechanisms to limit sensitive data and systems access.

- Educate employees on Cybersecurity best practices and provide regular training to ensure they are aware of the latest threats and how to prevent them.

- Implement data backup and recovery procedures to ensure data availability during a cyber attack.

- Implement a security incident response plan to ensure a timely and effective response to security incidents.